Managing finances in the United Kingdom has become extremely important in 2025, especially when the global economy continues to change. Whether you are a UK resident, student, worker, or entrepreneur, you need to understand how to manage money effectively. The value of the British Pound, banking systems, different types of credit cards, and easy international money transfer options can strongly influence daily life and long-term financial planning.

The UK is known for having one of the most advanced financial systems in the world. People from different countries come to the UK for education, job opportunities and business growth, which makes financial literacy important for everyone. This UK Finance Guide 2025 is designed to help you understand banking, credit, loans, currency value, and money transfers in simple language so you can make smarter financial decisions.

British Pound Value in 2025

The British Pound (GBP) is one of the strongest and most stable currencies globally. In 2025, the pound continues to play a major role in the European and global marketplace. Although exchange rates fluctuate depending on economic conditions, political decisions and global demand, the pound remains a trusted store of value.

A strong pound means imported goods may cost less, but exports can become more expensive for international buyers. People sending money overseas also notice the impact of exchange rates on the final amount received. Keeping track of the pound’s value helps you choose the right time for currency exchanges and international payments.

The Bank of England monitors inflation and adjusts interest rates to protect the value of the currency. Understanding these economic changes can help you better manage savings and investments.

Banking System in the UK

The United Kingdom has a highly trusted and secure banking system with global reputation. Banks provide multiple services such as current accounts, savings accounts, credit cards, loans, online banking and investment products. Almost all banks offer smooth digital banking through mobile apps, which makes it easy to manage finances anytime.

If you live, work or study in the UK, the first financial step is opening a bank account. You can choose between a current account for everyday payments and a savings account for earning interest. To open a bank account, required documents usually include identity proof like a passport, proof of address, and sometimes proof of income.

Most banks offer contactless cards for easy transactions, and payments through services like Apple Pay, Google Pay and Samsung Pay are widely accepted all over the UK.

Best Banks in the UK for 2025

Several well-established and digital banks make financial services convenient across the UK. Major banks like HSBC, Lloyds, Barclays, NatWest and Santander offer a wide network of branches and ATMs with reliable services. They provide current and savings accounts with different benefits based on monthly income and usage.

Digital-only banks like Monzo, Starling Bank and Revolut have become extremely popular because they have no hidden fees, higher savings interest, instant notifications, and very flexible features. These banks offer user-friendly apps that help track spending and manage budgets easily.

Students and workers who do not want to pay account maintenance charges can choose banks that provide fee-free accounts with cashback or reward benefits.

Savings Accounts and Interest Opportunities

Building savings is a smart step toward financial security. In 2025, UK banks offer competitive interest rates on savings accounts, especially fixed-term savings. Some accounts reward customers with higher interest if they deposit money every month without withdrawal.

There are also ISAs (Individual Savings Accounts) that allow savings without paying tax on the interest earned. This is a great way to grow money faster while protecting returns from taxation.

Setting aside money monthly for future needs like travel, emergencies, investments or education helps create financial independence and a peaceful life.

Credit Cards in the UK

Credit cards are widely used in the UK and can improve your borrowing ability when used responsibly. A good credit score is necessary for renting a house, getting a phone contract, applying for loans or buying a car or home. Choosing the correct credit card depends on your lifestyle and spending habits.

Some credit cards offer welcome points, cashback on groceries and fuel, travel rewards or 0% interest for a limited period. Low-interest credit cards are better for beginners who want to avoid heavy fees. Always pay your credit card bills on time to avoid penalties and maintain a good credit score.

Before applying for a card, checking eligibility and comparing offers helps prevent rejection and protects your credit history.

Best Credit Card Choices in 2025

In 2025, many people prefer rewards and cashback cards because they provide real benefits on daily spending. Some cards offer points that can be converted into flight tickets or hotel stays. Students can choose cards with zero annual fees and small credit limits to avoid overspending.

People who travel internationally can go for cards that charge no foreign transaction fees and provide travel insurance. Many online comparison platforms help find the right card according to financial situations.

With discipline and timely payments, credit cards can become a helpful tool for building financial strength in the UK.

Loans and Finance Support in the UK

Loans are an important part of financial planning when purchasing expensive goods or dealing with emergency expenses. There are two primary loan options: secured and unsecured loans. Secured loans include mortgages for buying a house, where the property acts as security. Unsecured loans are personal loans without collateral, but they usually have higher interest rates.

Loan applications require proof of income, employment, and credit history. People with good credit ratings get lower interest rates and faster approval. Always calculate the monthly repayment amount to ensure you stay within your budget and avoid financial pressure.

Online platforms and digital lenders offer quick approvals with minimal documentation, making personal loans more accessible than ever.

UK Mortgage and Home Loan Guide 2025

Buying property in the UK is a major life achievement. The housing market remains competitive in 2025, especially in big cities like London, Birmingham and Manchester. A home loan, also known as a mortgage, allows you to pay for your home over several years.

Banks offer fixed-rate and variable-rate mortgages. Fixed rates remain the same throughout the loan period, providing stability. Variable rates change depending on market conditions, and they may rise or fall over time.

Government programs such as first-time buyer schemes and shared ownership can help reduce the initial deposit needed to enter the property market. Mortgage pre-approval gives a clear view of your price range before searching for a home.

Car Finance and Vehicle Loans

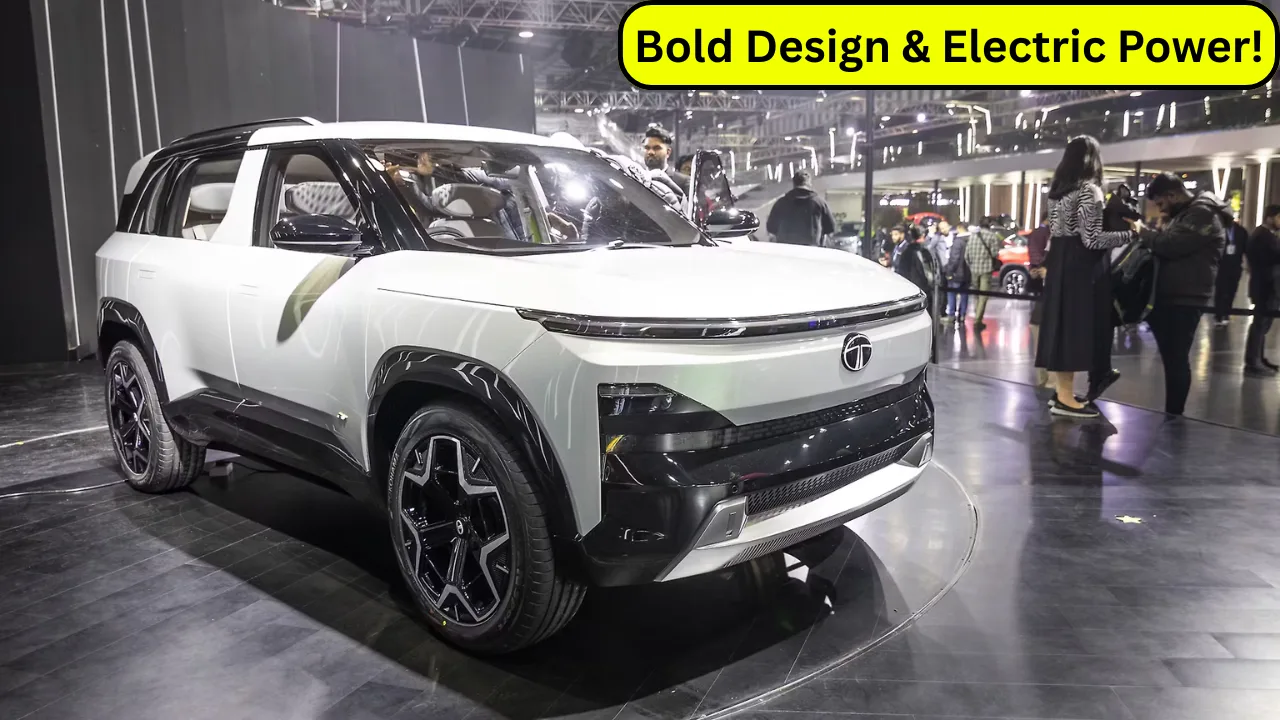

Car finance is common because private transportation is essential for many people in the UK. You can finance a car through banks or dealerships using loans like Hire Purchase (HP) or Personal Contract Purchase (PCP). PCP has become popular because the monthly payment is lower and buyers can choose to return or purchase the car at the end of the contract.

When selecting vehicle finance, you should also consider insurance and maintenance costs. Electric vehicles continue to grow in popularity due to government incentives and rising fuel prices.

Personal Loan Options for Daily Financial Needs

Personal loans help cover urgent expenses like medical needs, travel, home upgrades or educational support. Many digital lenders provide same-day approval and flexible repayment options. People who work as freelancers or self-employed individuals can choose low-doc loans where income proof requirements are relaxed.

Borrowing wisely and paying on time ensures financial balance and prevents unnecessary debt.

International Money Transfer from the UK

The UK has a large international community including students, expatriates and families with overseas connections. Transferring money globally should be affordable, fast and transparent. Traditional bank transfers sometimes charge high fees and offer less competitive exchange rates.

Digital transfer services like Wise, Remitly, Western Union and Xoom provide low-cost and faster international payments. Many people use these services for regular transfers to countries like India, Pakistan, Bangladesh, Nigeria and European nations.

Before sending money, checking the live exchange rate and service charge helps maximize the amount your family or recipient receives.

How to Build a Strong Credit Score in the UK

A good credit score is very important for financial growth in the UK. Paying every bill on time is the most effective way to improve credit history. Even small delays in phone bill payments can affect your score negatively.

Using a credit card responsibly, keeping low credit utilization and avoiding frequent loan applications help build a positive profile. Regularly checking your credit report helps you correct errors and avoid identity fraud.

A strong credit score rewards you with better loan approvals, lower interest and more banking benefits.

Insurance – Safety for Your Financial Future

Insurance is an important part of financial stability in the UK. Health insurance, car insurance, home insurance and life insurance protect you and your assets. Car insurance is mandatory for every car owner, and home insurance is essential when buying property.

Insurance provides peace of mind and protects against unexpected financial burdens like accidents, medical emergencies or property loss. Choosing the right insurance plan creates a safety shield for your family’s financial well-being.

Digital Payments and Cashless Lifestyle

The UK is rapidly moving towards a cashless economy. Mobile apps, contactless cards, QR payments and online services make transactions fast and secure. Digital payment systems reduce the need to carry cash and provide better spending control with instant updates.

Retail shops, restaurants and public transport widely accept contactless cards, making life more convenient. A cashless lifestyle supports transparency and financial growth.

Money-Saving Tips for Daily Living in 2025

Living in cities like London can be expensive. Smart spending decisions help reduce monthly expenses. Using store reward cards, looking for seasonal discounts and choosing budget-friendly supermarkets support better savings. Managing subscriptions and avoiding impulse shopping keeps your finances stable.

Tracking monthly spending using budgeting apps helps control expenses and enhances financial discipline. Saving a little every month builds long-term financial security and reduces stress about future needs.

Conclusion

The United Kingdom offers strong financial opportunities, modern banking, and a globally respected currency. Understanding how to manage money properly allows you to benefit from a stable financial environment. Whether selecting a bank account, applying for a credit card, taking a loan, buying a home or sending money worldwide, knowledge is your greatest tool.

2025 is a year where digital finance, smart planning and responsible spending can shape a secure future in the UK. By using financial services wisely, anyone can build stability, achieve goals and enjoy a better financial life.